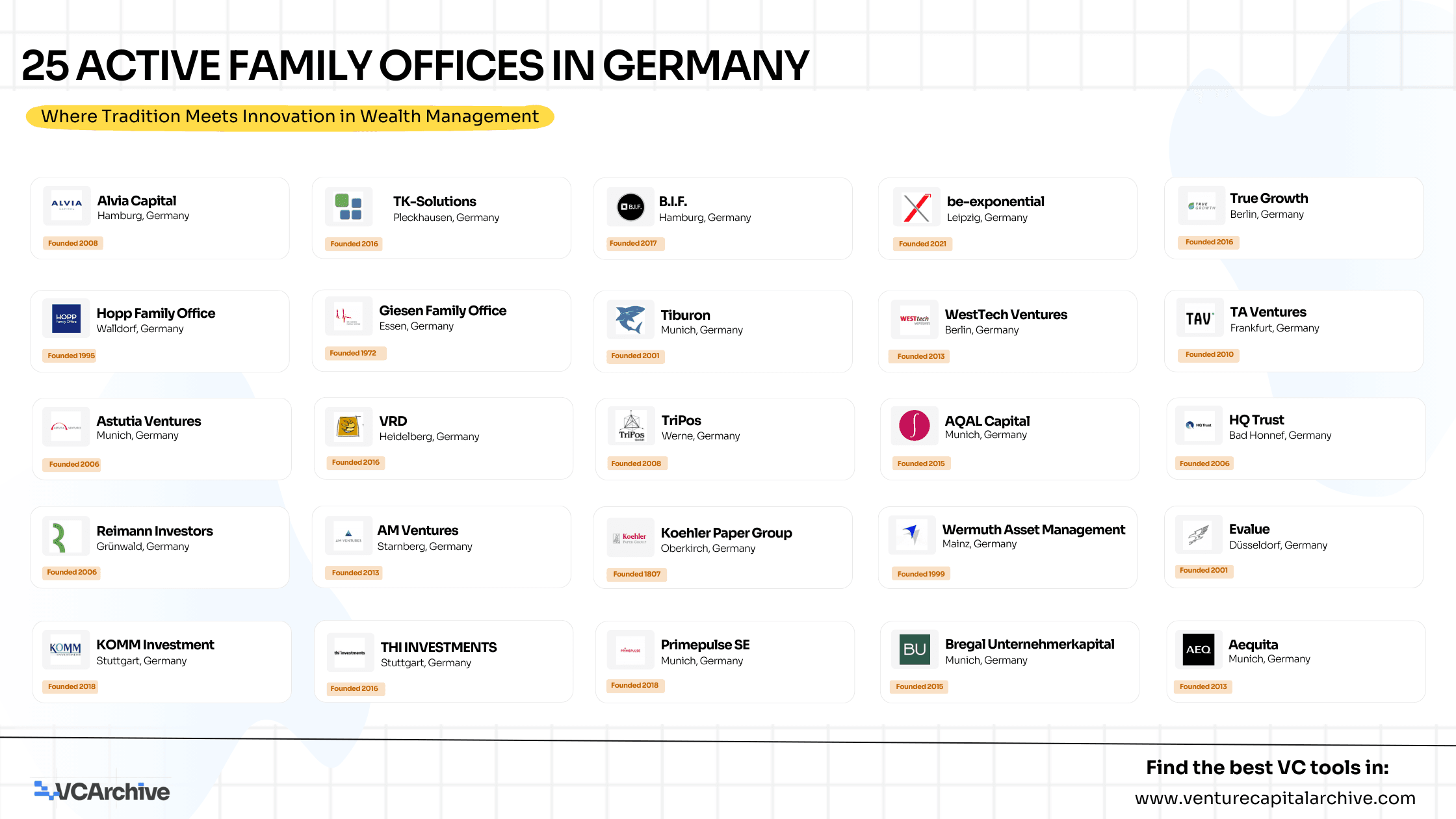

25 Active Family Offices in Germany

From technology and digital platforms to healthcare, sustainability, and real estate, family offices in Germany are increasingly embracing diversified portfolios. Many are establishing specialized investment vehicles, co-investing with global venture capital funds, and supporting both early-stage and growth-stage ventures.

Geographically, hubs such as Berlin, Munich, and Frankfurt remain central to family office operations, but smaller offices across the country are also emerging, signaling a broader democratization of private capital.

Most family offices focus on early and growth-stage investments, but there is also a noticeable appetite for alternative assets such as private equity, impact investing, and long-term real estate holdings.

Notable investment trends include:

Technology and SaaS- Tiburon, WestTech Ventures, TA Ventures, Reimann Investors

Healthcare and Life Sciences- Alvia Capital, Hopp Family Office, TA Ventures, THI Investments

Sustainability and ClimateTech- Wermuth Asset Management, AM Ventures, Primepulse SE, AQAL Capital

Real Estate and Asset Management- TriPos, HQ Trust, Giesen Family Office, Koehler Paper Group

This curated snapshot highlights where strategic, thesis-driven capital is emerging in Germany. Whether you’re a founder seeking investment or an LP analyzing regional family office activity, understanding these patterns is key to aligning with influential players.

Explore the full list of 25 active family offices in Germany, including their sector focus and investment strategies, now live on VCArchive.

25 Active Family Offices in Germany